The Zalando Share – 2016 in Review

- Despite external market volatility, the Zalando share price remained stable

- Broad analyst coverage by 28 brokers

- Successful second annual general meeting on May 31, 2016

SHARE AND CAPITAL MARKETS DEVELOPMENT

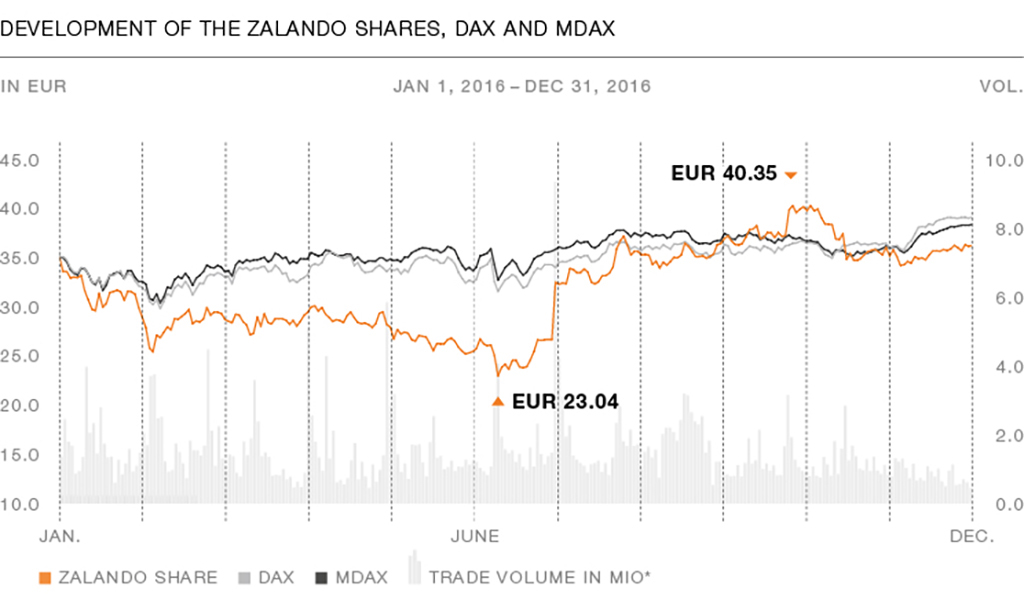

In 2016, the development of international capital markets continued to be driven by the low-interest rate environment. The start of the year was marked by a downturn of international and German stock markets on concerns about the growth outlook of the Chinese economy. While the German index DAX recovered to 10,500 points, volatility remained until the unexpected result of the Brexit referendum on June 23, 2016 marked a sharp decline of 1,000 points for the DAX index over the following trading days. Nevertheless, capital markets of industrialized countries developed positively over the course of the summer, driven by globally supportive central bank policies. At the same time, future interest rate policy of the US and other central banks, as well as the US presidential election, were among frequently discussed topics on Frankfurt’s trading floors. The surprising outcome of the US elections led to unforeseen movements in capital markets, particularly towards sectors likely to benefit from the change in government.

The Zalando share closed the year 2015 at an all-time high of EUR 36.40, but felt the overall market weakness in the first weeks of 2016 when the share price decreased to EUR 25.48 in early February. Thereafter, the share price recovered, followed by a slight downward movement after the release of the first quarter results. Following the Brexit vote in June, the Zalando share hit its annual low of EUR 23.04, but recovered in line with overall global equity markets. The positive share price development was further accelerated by the publication of the Q2 Trading Update on July 19 and the increase in full-year 2016 adjusted EBIT margin guidance resulting in a share price of EUR 32.55 at market close. The Zalando share reached its all-time high of EUR 40.35 on October 27, 2016 in light of the publication of the Q3 Trading Update that led to a further increase in full-year 2016 adjusted EBIT margin guidance. However, the outcome of the US elections triggered a sector rotation that put pressure on the entire e-commerce sector, including Zalando. At year-end, the share closed at EUR 36.29, slightly below the previous year’s level. It slightly underperformed the DAX (– 7.9 %) and the MDAX (– 5.9 %). The market capitalization at year-end was EUR 8.9bn (basic).

| *) | Based on trading on XETRA, German stock exchanges, electronic communication networks (“ECNs”) and over-the-counter (“OTC”) trading. Source: Bloomberg |

| THE ZALANDO SHARE | |

| Type of shares | Ordinary bearer shares with no par value (“Stückaktien”) |

| Share capital | EUR 247,255,868 |

| Total numbers of shares outstanding (Dec 31, 2016) | 247,255,868 |

| ISIN | DE000ZAL1111 |

| WKN | ZAL111 |

| Bloomberg | ZAL GR |

| Thomson Reuters | ZALG.F |

STABLE SHAREHOLDER BASE

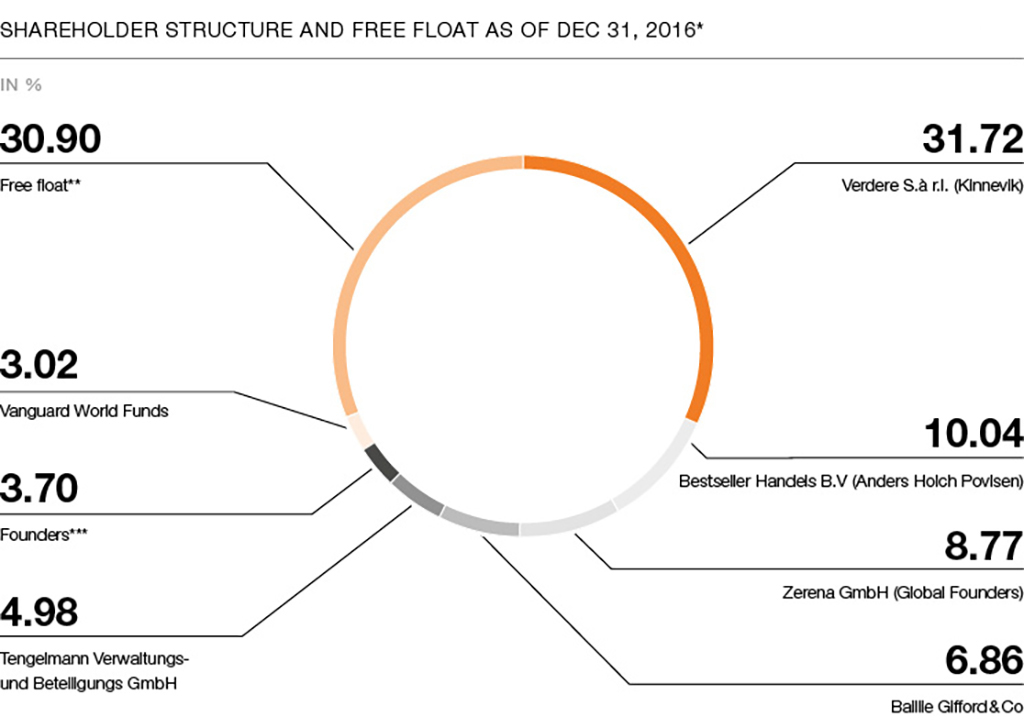

The shareholder structure of ZALANDO SE remained stable throughout the year. The free float decreased from 37.24 % to 30.90 %, mainly driven by additional stock purchases of existing shareholders: In March and June Baillie, Gifford & Co increased its shareholding to a total of 6.86 % from previously 3.08 %. Bestseller Handels B.V (Anders Holch Povlsen) also increased its shareholding in March from 9.35 % to 10.04 %. The inclusion of the Zalando share in several indices triggered the index-tracking fund Vanguard World to increase its position to a total of 3.02 %, thereby exceeding the 3 % threshold. The Zerena GmbH (Global Founders) reduced its shareholding from 9.92 % to 8.77 % in May.

| SHARE PERFORMANCE | |

| Opening price on Jan 4, 2016 | EUR 36.40 |

| High 2016 (Oct 27) | EUR 40.35 |

| Low 2016 (June 27) | EUR 23.04 |

| Closing price on Dec 30, 2016 | EUR 36.29 |

| Performance 2016 | – 0.3 % |

| Average daily trading volume 2016 (shares)* | 1.5M |

| Average daily trading volume 2016 (EUR)* | EUR 48.8m |

| *) | Based on trading on XETRA, German stock exchanges, electronic communication networks (“ECNs”) and over-the-counter (“OTC”) trading. Source: Bloomberg |

ANALYST COVERAGE AND STOCK INDICES

In 2016, the Zalando share was covered by 28 financial analysts from Germany and abroad, resulting

in higher awareness of the Zalando share.

The Zalando share is listed in numerous important domestic and foreign indices. These include the German MDAX, which comprises the 50 listed companies in Germany following the DAX index, the broader European STOXX Europe 600 Index and the German Entrepreneurial Index GEX. The Zalando share is also listed in relevant industry indices such as the STOXX Europe 600 Retail Index and the Deutsche Börse Prime Retail Performance Index.

SUCCESSFUL SECOND ANNUAL GENERAL MEETING 2016

On May 31, 2016 ZALANDO SE hosted its second annual general meeting (“AGM“) post IPO. Those in attendance, representing 89.6 % of the voting share capital, approved all the proposed resolutions put forward by the company’s Management Board and Supervisory Board. Resolutions included the authorization for granting subscription rights to shares and the authorization to issue Stock Appreciation Rights. During the subsequent Supervisory Board Meeting, Lothar Lanz, already member of the Supervisory Board, was elected as the new chairman replacing Cristina Stenbeck. Furthermore Kai-Uwe Ricke was elected as the new chairman of the audit committee.

| *) | Voting rights held directly or by a subsidiary. The overview reflects the notifications pursuant to Section 21 WpHG (“BaFin-notifications”) and Section 26a WpHG (change in total voting rights) received by ZALANDO SE as of November 18, 2016. |

| **) | Free float calculated as total less BaFin filings and founders’ stake |

| ***) | Aggregate shareholding of the founders |

ACTIVE COMMUNICATION WITH CAPITAL MARKETS

Proactive dialogue with investors and analysts is a key element in our external communication. As a result of our continuous interactions, we have established strong relationships which we aim to further deepen and expand.

Throughout the year 2016, the Management Board together with the SVP Finance and the Investor Relations department, spent 26 days visiting existing, and potential shareholders in the major European and North American financial hubs and participated in twelve industry and country-specific investor conferences. In addition, our Investor Relations activities included numerous meetings with individual investors in Berlin, as well as numerous video and telephone conferences. Moreover, interested investors and analysts had a chance to participate in our field trips to our fulfillment center in Erfurt, as well as guided tours through our fashion and tech hubs.

On March 22, 2016, our second Capital Markets Day took place, this time in our Berlin headquarters. This day has quickly turned into a well-established annual flagship event for investors and analysts. With around 70 international participants – both analysts and investors – the event was very well attended. In various presentations, the Management Board and senior management presented the platform strategy in great detail and discussed the development of the respective business units in depth. Other key topics included developments within technology and operations. The insights into strategic and overall relevant topics were finally rounded off by a visit to our fulfillment center in Erfurt.

Going forward, we will continue to inform capital market participants in a regular dialogue about the current and future business development. For the latest information on business updates, the Zalando share, financial reports, press releases, company presentations and our financial calendar, please visit our website corporate.zalando.com/en/ir.

For any other information, please contact Birgit Opp, VP Corporate Finance and Investor Relations (investor.relations (at) zalando.de).

Robert Gentz Co-founder and member of the Management Board, Rubin Ritter Member of the Management Board, David Schneider Co-founder and member of the Management Board